The Canadian sugar industry is internationally unique in that it does not depend on government subsidies. Basing its prices on world raw sugar markets, it sells sugar at prices that are among the lowest in the world.

Since its inception, the Canadian sugar industry has operated under an open market policy, based on the principles of free trade. By aligning sugar prices closely with world market raw sugar prices, Canadian refiners have been able to market refined sugar at prices below those of almost all other industrial nations.

In most other countries, government intervention supports sugar prices at artificially high levels and imports are restricted. While these policies protect the domestic sugar producers in these countries, they also result in higher prices for the consumer and sugar-containing product manufacturers. Canada's low sugar prices benefit Canadian consumers and have helped many sugar-using food manufacturers to compete internationally.

Cane and beet sugar refining is a vibrant and efficient industry that makes a significant impact on the national, provincial and local economies in communities across the country.

National Economic Impact

The Canadian sugar industry produces approximately 1.4 million tonnes of refined sugar annually in four provinces with an estimated value of shipments of approximately $1.75 billion dollars (2023).

Efficient sugar production has contributed in a major way to the development of a vibrant value-added food processing sector, Canada's second largest manufacturing industry and the largest manufacturing employer. Food and beverage processing is the top manufacturing industry in most Canadian provinces, and consumer-oriented food and beverage products represent half of all Canadian agri-food exports (See: Agriculture and Agri-Food Canada).

Canadian sugar users enjoy a significant advantage – the average price of refined sugar is generally 30 to 40 per cent lower in Canada than in the U.S. Most manufactured products containing sugar are freely exported to the United States and other countries.

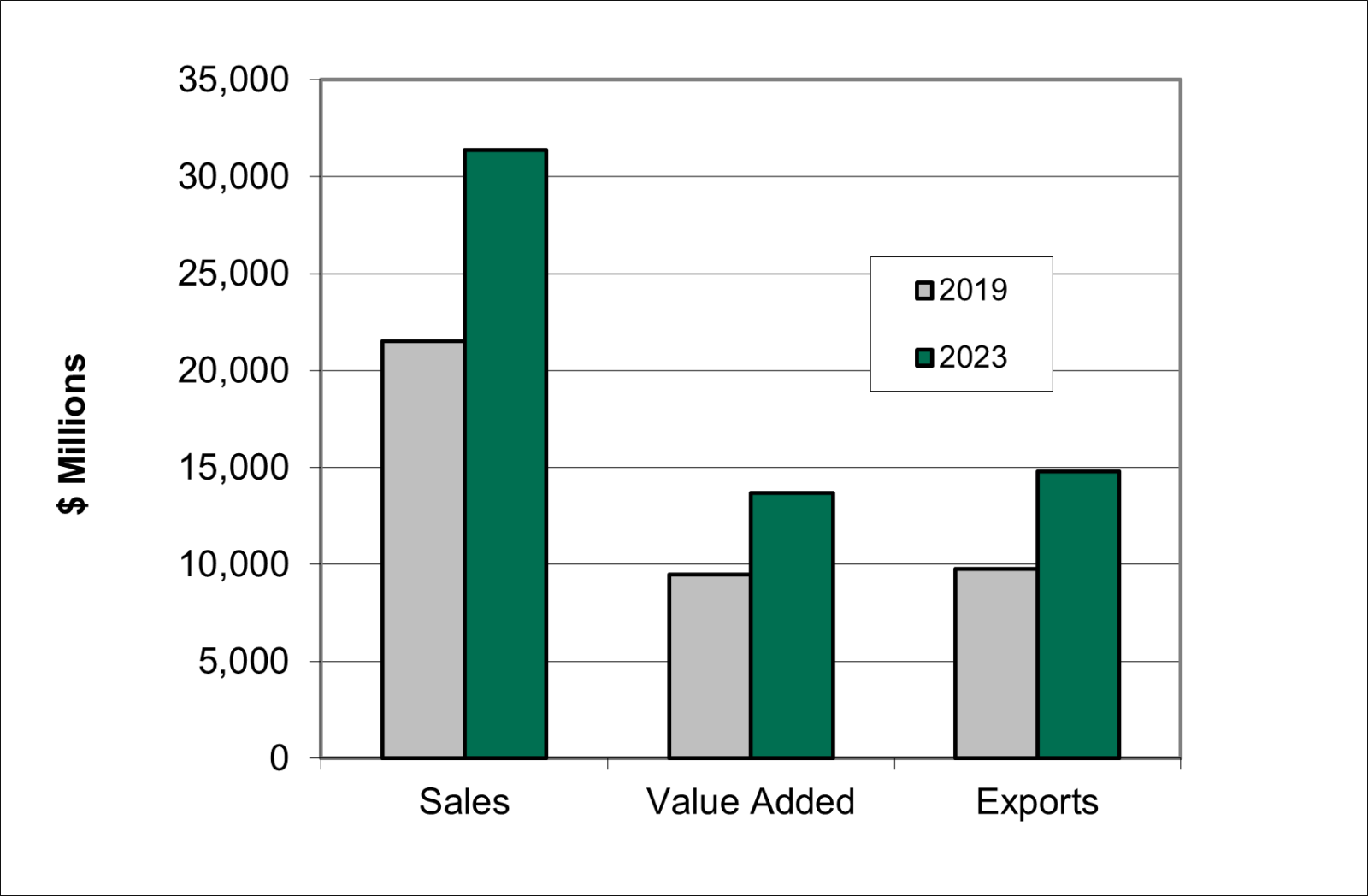

High quality, low-priced sugar is an essential input to major sugar-using food manufacturers. Over 85% of Canada's refined sugar is sold for further processing into value-added food products, accounting for over $31.4 billion in sales and 19% of all Canadian food manufacturing sales in 2023. Value-added by major sugar users is relatively high at an average 44% compared to the food manufacturing average of 34%.

Canadian refined sugar continues to be a significant factor driving investment and export growth. Approximately 45% of Canadian refined sugar production is exported in sugar-containing food products. Exports of sugar-containing products grew from $9.5 billion in 2019 to $14.8 billion in 2023.

Employment in major sugar using food companies (close to 72,000 employees) represents about a third of total food manufacturing employment. Major sugar using industries are listed below.

- Bread and bakery product manufacturing

- Sugar and confectionery product manufacturing

- Fruit and vegetable preserving and specialty food manufacturing

- Breakfast cereal manufacturing

- Cookie and cracker manufacturing

- Ice cream and frozen dessert manufacturing

- Flour mixes and dough manufacturing from purchased flour

- Flavouring syrup and concentrate manufacturing

In addition, sugar is used in producing wine, beer, and other alcoholic beverages, animal feed, seasonings and dressings, and for non-food uses such as plastics and pharmaceuticals.

By generating demand for goods and services, the sugar industry also indirectly supports a number of other economic sectors, including agriculture, natural resources, packaging, industrial machinery, and transportation.

Sugar Using Food Manufacturing Growth 2019-2023

"Value-added" is linked to Sugar

Value-added is a measure of the increase in value of a product above the raw material costs and services. In contrast to total shipments or sales, it provides insight into the economic benefit from processing and marketing an agriculture commodity in Canada. There is a high degree of "value-added" to raw sugar and sugar beets to produce various refined sugar products to meet both consumer and industrial needs. There is further "value-added" when refined sugar is purchased as a major ingredient by food processors. All of these steps provide employment and strengthen Canada’s economy

Provincial Economic Impact

Alberta

Taber, Alberta is home to the Rogers Sugar (Lantic Inc.) sugar beet processing plant. Rogers Sugar contracts with sugar beet growers to plant approximately 25 - 30,000 acres each year to supply the Taber plant. This ensures continued supply of high quality beet sugar production for the western Canadian and export markets. Sugar beets are one of Alberta's main irrigated crops and Alberta is the only province to produce sugar from sugar beets. About 250 Alberta farms plant about 30,000 acres of beets each year for processing at Taber.

Taber's sugar beet processing plant is the only one of its kind in the country. The plant has a processing capacity of 150,000 tonnes and is one of the most advanced sugar beet plants in North America. The plant underwent a $40 million expansion at the end of the 1990s. Installation of a wastewater facility for the plant created more than 20,000 hours of employment alone. Plant expansion has led to an increase in permanent employment and major growth in the local economy through housing starts, retail development and the growth of service industries.

About 200 farm families plant sugar beets each year for processing at Taber. Alberta’s sugar beet industry contributes to the provincial economy through employment and requirements for goods and services. Approximately 800 employees are directly associated with sugar beet farming in Alberta, including full time, part time, seasonal and contract workers. The direct economic impact is about $40 million in farm gate revenue and the value-added from sugar beet processing is approximately $75 million annually. The total economic impact of Alberta’s sugar beet industry (direct, indirect and induced) is estimated at approximately $250 million. (See: Sugar beets are important to Alberta’s economy.)

Beet sugar produced in Alberta from Alberta sugar beets is the only sugar that qualifies to be exported to US quotas for "originating" Canadian sugar.

Production in the Taber facility includes granulated and powdered sugars in several package sizes. There are also two types of liquid sugar produced in Taber, liquid sucrose and liquid invert sugar. Both are shipped to industrial customers via bulk tankers.

Sugar beet harvest, Rogers Sugar, Taber Alberta

Sugar Ingredient Costs Support Food and Beverage Processing in Alberta

Sugar ingredient costs in Alberta are less than half of the sugar costs at US locations. In comparison to the United States, the opportunity for sugar-using food and beverage manufacturing in Alberta is driven by the availability of locally produced sugar at world market prices. No provincial sales tax in Alberta also contributes to the cost advantage.

In 2022, Alberta's food and beverage manufacturing industry accounted for 15% of total food sales in Canada and the province ranked as the third largest food processor in Canada, after Ontario and Quebec. Food and beverage shipments have grown to $24.1 billion, representing over 21% of total manufacturing in the province. Increases in sugar and sugar-using industries such as confectionery, bakery and fruit and vegetable processing contributed to the gain (See also: Alberta Agricultural Statistics Factsheet and Alberta Food Data Facts).

The province of Alberta is strategically located to access North American and Asian markets. Alberta is the second largest exporter of primary and processed agricultural and food products in Canada, after Ontario. In 2022, processed agri-food product exports from Alberta were valued at $8.7 billion.

Food companies that locate production in Alberta can benefit from a reliable supply of high quality, low cost sugar. From a globally competitive location, companies can deliver products meeting high quality standards for customers throughout North America.

British Columbia

Vancouver, British Columbia is home to one of Canada's three cane sugar refineries. The Rogers cane sugar refinery is located on the Port of Vancouver's south shore. The refinery can produce up to 240,000 tonnes of sugar per year from imported raw cane sugar. The production output of the plant largely depends on the output of the Taber Alberta beet sugar facility and the variable US export opportunities that draw sugar from that plant. Sugar produced at the Vancouver refinery is sold to retail and industrial customers throughout western Canada. Rogers Sugar continues to invest in its Vancouver refinery to ensure that it can continue to meet its customers needs for high-quality, efficiently-produced sugar. The Company's sugar products are marketed primarily under the "Rogers" trade name and include granulated, icing, cube, yellow and brown sugars, liquid sugars and specialty sugars and syrups.

Rogers Sugar, Vancouver, BC

Rogers Sugar is Strategically Located to Supply BC's Food Processing Sector

British Columbia's food and beverage processing sector is the second largest manufacturing industry in the province. BC's beverage processing is the third largest in Canada and food processing is the fourth largest nationally.

BC's food and beverage processing employs approximately 39,000 Canadians with sales valued at over $14.2 billion (2022). A wide variety of locally processed food and beverage products use sugar as an important input, such as sweetened dairy products, cereals, baked goods, confectionery products, preserved fruits, and specialty food products. Rogers Sugar is strategically located to supply sugar to the majority of BC's food processing companies that are located in the lower mainland (See also: BC Agriculture & Food Processing).

Food and beverage processing firms locate in B.C. because of its developed transportation infrastructure, access to international markets through ports, and a significant and diverse consumer base in the Lower Mainland. BC food and beverage processors benefit from the abundance of a diversity of agricultural resources and inputs, including refined sugar.

The British Columbia food industry is dominated by a large number of small and medium sized firms which provide the industry with operational flexibility in responding to shifts in consumer tastes and preferences. These firms rely on a steady supply of high-quality, competitively priced Canadian sugar.

Ontario

Ontario is home to major sugar industry facilities:

- Redpath Sugar Toronto Refinery: Built in 1959, Redpath's cane sugar refinery on the Toronto waterfront continues to serve Canadian consumers and food manufacturers in eastern Canada. In 1997, Redpath completed a $40 million expansion and modernization initiative that increased the plant's production capacity by 75%. In 2023, a further investment increased the capacity by a further 65,000 metric tonnes as a strategic response to growth in demand in Canada’s food manufacturing sector.

- Redpath Custom Packing Belleville, Ontario: Produces value-added sugar-containing products, such as iced tea mixes, drink crystals, hot chocolate, and sugar gelatin blends for Canadian and American manufacturing and retail customers.

- Lantic Sugar, Toronto distribution centre: Distributes Lantic Sugar products in central Canada. Along with an increase in Lantic’s Montreal refinery capacity, Lantic is investing in logistics and storage capacity in the Greater Toronto Area to serve the growing Ontario food-processing market.

Redpath Sugars, Toronto, ON

Low Sugar Costs Attract Investment in Ontario's Food Processing Sector

Food processing is the second largest manufacturing industry in Ontario. The combination of high-quality local food ingredients (including sugar), a skilled and educated workforce, low business costs, central location, world class research facilities and an excellent transportation system give Ontario an advantage over competing jurisdictions.

Ontario is North America's third largest centre for food and beverage processing and about 3,000 companies located in Ontario employ close to 105,000 Canadians. Ontario's food processing sector contributes $59.5 billion to the economy (Ontario Ministry of Agriculture, Food and Rural Affairs).

Ontario has attracted substantial investment in major sugar-using food processing sectors, which represent $16.5 billion in sales (2022) and account for almost 30% of total food manufacturing in the province. The confectionery and baking sectors are most significant, and together account for 23% of Ontario's food processing market. Major food companies as well as small and medium enterprises continue to add new investments in Ontario, related in part to low sugar costs relative to US locations. Ontario is home to major sugar-using food and beverage processing establishments, including companies such as Coca Cola, Nestle, PepsiCo, Kellogg's, Unilever, Kraft Heinz, Ferrero, Maple Leaf Foods, Dare Foods, and Weston Foods (See also: Invest in Ontario's Food and Beverage Industry and Invest in Ontario).

Ontario is a production and distribution centre for major markets with the United States representing the most important market for exports of sugar-containing products. Major sugar-using food exports from Ontario to the US are valued at $9.5 billion (2022) and account for 70% of all Canadian exports of these products to the US.

Quebec

Lantic Inc. owns and operates a cane sugar refinery on a 12-acre lot in eastern Montreal. The original plant was built in 1888. Over the years, the building and processing facilities have been frequently upgraded and a major expansion was completed in 2000. This investment doubled the refinery's regular capacity to 440,000 tonnes and with overtime, plant output can exceed 600,000 tonnes. In August 2023, Lantic announced a $200 million investment to further expand the Montreal plant’s capacity by 20% or approximately 100,000 tonnes. This new capacity is responding to increased investment in eastern Canada’s food processing industry. The incremental production and logistics capacity is expected to be in service in approximately two years.

Food Processing in Quebec Benefits from High Quality, Low-Cost Sugar

"With its rich rural tradition and forward-looking entrepreneurship, the agri-food industry is a major contributor to Quebec's economy. Examples of major sugar-using food companies that have invested in Quebec include Barry Callebaut, Danone, Frito-Lay, Kraft, Nestlé, Parmalat, Pepsi, and Coca Cola (See also: Investissement Québec, Agri-food).

Lantic Sugar, Montreal, QC

The food processing industry is Quebec's leading manufacturing industry and represents approximately 68,000 jobs. Food processing shipments were $35 billion in 2022 and food manufacturing exports were $8.3 billion in 2023.

Food processing is characterized by the predominance of small and medium-sized businesses, as well as artisan enterprises that make use of the wealth of local ingredients, including high-quality, low-cost sugar.

There are over 2,400 food processing businesses in Quebec, representing a wide range of sectors, many of which use sugar as a major ingredient. This includes bakeries, beverages, sweetened dairy products, fruit preserving and sugar and chocolate confectionery producers. Sales of major sugar-using food products account for approximately $5.5 billion in sales and $2.9 billion in exports.

Sugar prices benefit food processors in every Canadian province

The positive economic impact of an efficient domestic sugar industry is felt in every Canadian province, not only those that are home to sugar refineries. The food processing sector is the largest or second largest manufacturing sector in all provinces. A steady supply of low-cost, high-quality sugar is an important ingredient in the success of the food processing sector. Retail consumers also benefit from Canada's efficient sugar industry as domestic sugar prices are significantly less than those in the United States, where sugar is subject to government controls and high support prices.